|

FOR IMMEDIATE RELEASE W Ketchup Urges Americans to Protect Themselves from the Greatest Theft in History

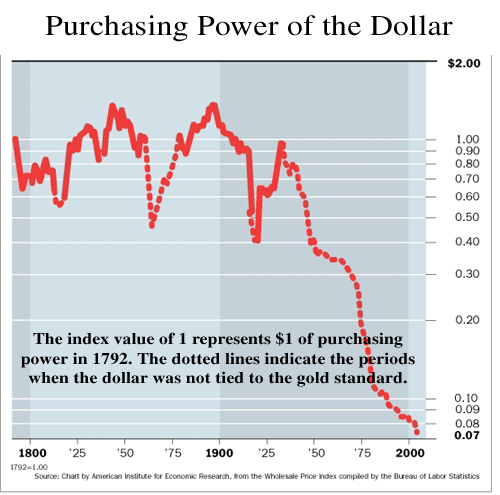

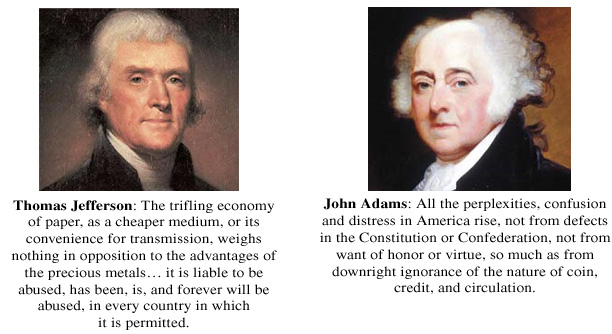

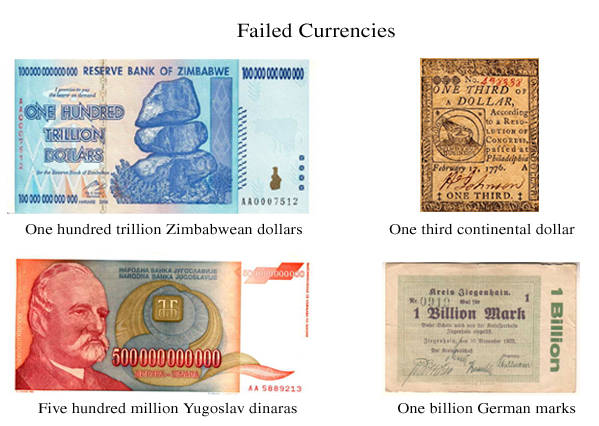

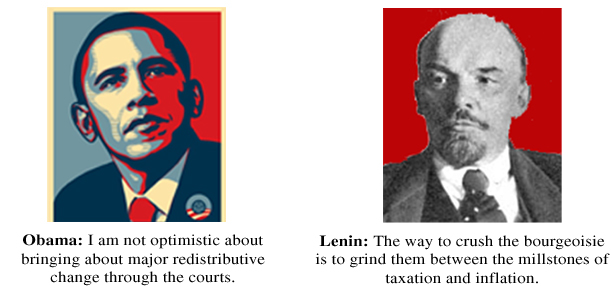

During inflation, the nominal price of assets increases, while the nominal value of debts stays the same. Since debt shrinks as a percentage of asset value, inflation results in wealth being transferred from the lender to the borrower. Thomas Paine condemned “unscrupulous traders who buy up great holdings on credit, agitate for increased issues of paper money, and pay their debts with depreciated currency which they get at little price.” Chastened by this early experience with fiat currency, the founding fathers rejected paper money in favor of gold and silver. The Constitution gives Congress the power to: “coin Money, regulate the Value thereof....” In fact, the Consitution specifically prohibites the States from making anything “but gold and silver Coin a Tender in Payment of Debts.” Except for brief periods during time of war, the American dollar held its value from 1792 until 1932, the year Franklin Roosevelt initiated the “New Deal.” FDR outlawed private ownership of gold and effectively took America off the gold standard. Since then the value of the dollar has been set by the Federal Reserve through the manipulation of interest rates. It has lost 92% of its value during this time. The Federal Reserve is constantly lowering the value of the dollar, meaning wealth is constantly being transferred from creditors to debtors. This tendency has encouraged debtors to borrow as much money as possible and explains why total American debt currently stands at 390% of GDP, versus only 150% of GDP in 1975. In 1932 the United States was the world’s largest creditor nation, which propelled it to superpower status. The U.S. is now the world’s largest debtor nation. The Federal Government is $11 trillion in debt -- nearly one third of it owed to foreigners -- not including $49 trillion in unfunded Social Security and Medicare obligations. President Obama’s budget proposes to increase spending this year by 32% to $3.9 trillion. This would increase headline federal debt to $15 trillion by the end of Obama’s first term. With asset values and GDP falling, current debt levels are unsustainable. The only two ways a country can reduce its debt in the face of increased spending are increased taxes and/or inflation. Obama has proposed increasing marginal income taxes, introducing new taxes on healthcare benefits, increasing taxes for social security, and implementing a “cap and trade” system that would raise $300 billion a year in taxes on all Americans who use energy. Outrageously, he has even proposed charging wounded soldiers for their own medical care. Federal Reserve Chairman, Ben Bernanke, has discussed his role in the debt crisis saying: “The US government has a technology, called a printing press, or, today, its electronic equivalent, that allows it to produce as many dollars as it wishes at essentially no cost. By increasing the number of US dollars in circulation, the US government can also reduce the value of a dollar in terms of goods and services, which is the equivalent of raising the prices in dollars of those goods and services.” Dan Oliver, CEO of W Ketchup commented: “Ben Bernanke means what he says. Since August he has doubled the monetary base. It is clear that his intention is to repeat FDR’s strategy of debasing the dollar in order to reduce the real value of debt. This will result in a massive transfer of wealth from responsible savers to irresponsible profligates. The continental, the German mark, the Zimbabwean dollar and many other currencies were discontinued only when the printers could no longer afford ink and paper. Bernanke has telegraphed the world that the cost of paper and ink will not limit his printing of currency. Anyone holding dollars is at risk.” Oliver added: “The only currencies that have kept their stores of value over thousands of years have been gold and silver. This is why the Founding Fathers designed the country to work on the solid monetary foundations of precious metals.” W Ketchup Chairman Bill Zachary commented: “In a 2001 interview, Obama suggested that the goal of the progressive movement should be to redistribute wealth. As President, he can achieve his goal through regulation, inflation, and taxation. We recommend to our customers that they preserve their wealth by buying real assets until America votes out Obama and his band of socialists.” In 1985 President Reagan signed a law ordering the U.S. Treasury Department to produce gold and silver coins in quantities sufficient to meet public demand. These coins may be purchased directly from the U.S. Mint or more cheaply from coin dealers. In case of crisis, W Ketchup recommends its customers also keep on hand a healthy supply of delicious W Ketchup, which as a last resort can be used for bartering purposes. To order delicious W Ketchup, please click on the link below: W Ketchup donates a portion of every purchase to the Freedom Alliance Scholarship Fund, which helps fund college tuition for the children of America’s fallen heroes. Founded in 2004, W Ketchup™ is a private company that makes ketchup

in |

|

|

©2004 W Ketchup, LLC